ACH Onramp

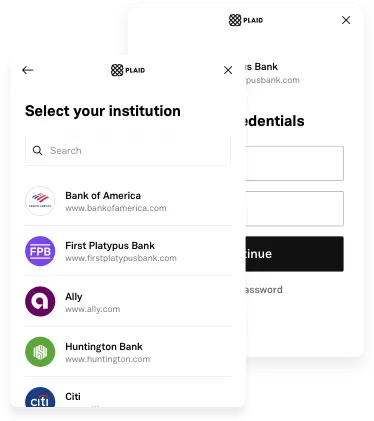

Connect bank accounts with Plaid or ACH / Bank Details

There are 2 methods to connect a bank account to Wyre:

- Integrate with Plaid

- Create payment method via bank details

KYC

All ACH Onramp transfers require KYC but the KYC requirements will differ depending on limits and where the funds go.

| Limits | Wyre Custody? | KYC Requirements |

|---|---|---|

| $2,500/week | No | Legal Name, Address, DOB, phone, Government ID, Bank Authentication (Plaid) |

| $2,500/week | Yes | Legal Name, Address, DOB, phone, Government ID, Bank Authentication (Plaid), Social Security or Tax ID Number |

| $25,000/week | No | Legal Name, Address, DOB, phone, Government ID, Bank Authentication (Plaid), Social Security or Tax ID Number |

| $25,000/week | Yes | Legal Name, Address, DOB, phone, Government ID, Bank Authentication (Plaid), Social Security or Tax ID Number |

KYC for ACH will require the Users API integration if done outside of the widget.

Lower limits without custody is not available in the Wyre Widget.

Connect with Plaid

The Wyre LOCAL_TRANSFER connection flow leverages your Plaid Link account in order to make it easy for your customers to connect their bank account to their Wyre account. You can activate Wyre within the Plaid integrations dashboard. Refer to the Plaid for Bank Transfers guide for finishing the link and passing the processorToken.

Creating Payment Methods Via Bank Details

We can pass bank details to the Create Payment Method endpoint.

//US payment method details

{

"paymentMethodType": "INTERNATIONAL_TRANSFER",

"paymentType": "LOCAL_BANK_WIRE",

"currency": "USD",

"country": "US",

"beneficiaryType": "INDIVIDUAL",

"firstNameOnAccount": "Sally",

"lastNameOnAccount": "Smith",

"beneficiaryAddress": "1234 Main St.",

"beneficiaryAddress2": "",

"beneficiaryCity": "Los Angeles",

"beneficiaryPostal": "91604",

"beneficiaryPhoneNumber": "+15555555555",

"beneficaryState": "CA",

"beneficiaryDobDay": 2,

"beneficiaryDobMonth": 12,

"beneficiaryDobYear": 1990,

"accountNumber": "1234567890123",

"routingNumber": "123412312",

"accountType": "CHECKING",

"chargeablePM": false

}

Account Number

Please note that the

accountNumberparameter should be your bank account number, i.e. checking or savings account number. This should not be your Wyre account id.

A payment method must be approved in order to pull funds from it. Once approved, the payment method will transition from PENDING status to ACTIVE. When setting chargeablePM to true, a bank statement upload is required to move the account from AWAITING_FOLLOWUP to PENDING. After a successful review of the bank statement, the status will transition to ACTIVE.

When you create a Payment Method using this API it will return with a status of AWAITING_FOLLOWUP. If you have set chargeablePM to false then the status will remain AWAITING_FOLLOWUP, however, you will be able to make payouts (push) to the payment method.

Bank Document Upload

In the case that we are adding banks via banking details or when the name on the bank account does not match the name of the User account, Wyre will require a Bank Document Upload

Document requirements

We require a digital bank statement. Must be within the last 3 months and show a full month of transactions.

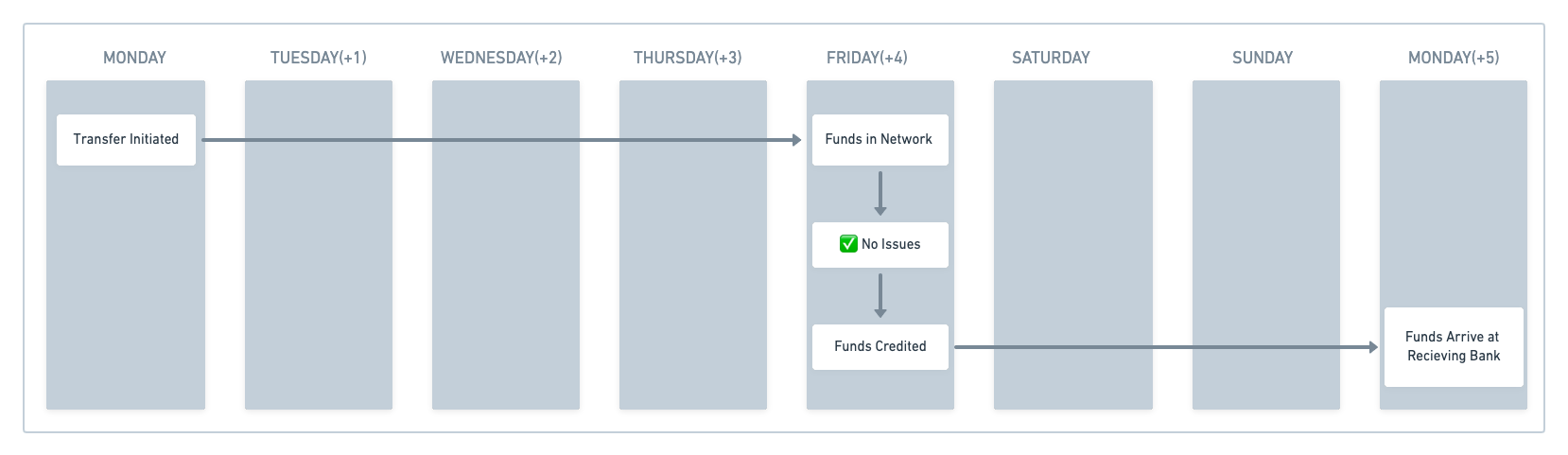

ACH Funds Delivery Timeline

ACH transfers should be delivered 5 business days after the date of initiation. The expected delivery date of funds can be impacted due to bank holidays and weekends.

ACH Failure Notifications

ACH transfers are done through the Create Transfer endpoint. A transfer id is generated for every initiated transfer, including ACH deposits. You can query the transfer by id to get details from the API regarding ACH failures.

| Error Message | Reason |

|---|---|

| An unexpected error occurred while connecting with your bank. Please try again later. | Wyre is unable to authenticate with the bank account or cannot receive an accurate balance from the bank account. |

| Insufficient available balance. Please deposit additional funds or adjust your purchase amount and try again. | There are insufficient funds in the connected bank account. |

| We are unable to complete the transaction. We have returned the deposit to the funding account. | Wyre's team has determined that the ACH transfer is not to be processed. |

Set up Auto-Liquidation Address

Wyre enables our partners to give a payment method its own blockchain addresses for instant liquidation. Refer to our Bank Payouts guide for more information.

Sample ACH Electronic Mandate

Your app must clearly display the date which the user will be charged and allow them to accept Wyre's User Agreement.

Updated over 3 years ago